We Manage Bonds of All Sizes

SURETY BONDS

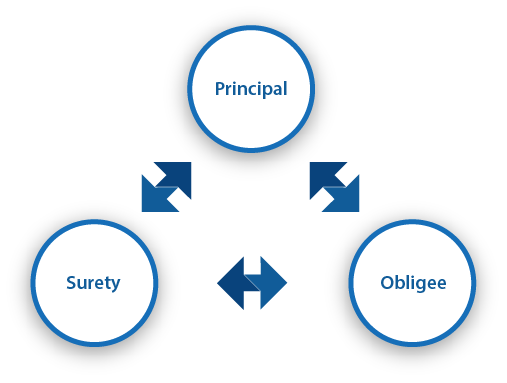

Surety bonds are forms of guarantees and under a surety, a third party becomes liable upon the default of the principal, who is the debtor or guaranteed party. Surety bonds are intended to satisfy security requirements and to protect against financial risk. We place both conditional and unconditional surety bonds for international projects. Our expertise is offered to multinational clients seeking contract guarantees and commercial bonds on a global basis. The clients we serve range from all sectors including construction, trade and financial services, private lenders, high net worth individuals, real estate and oil and gas. In many countries, our bonds are accepted as an alternative to traditional bank guarantees. We can provide surety bonds for obligations held in trust, and those imposed by protection acts and tax obligations.

Our $500 million individual bonding capacity gives us the flexibility and scale to support diverse industries. A rigorous approach is applied and through our understanding of this important credit tool, we are able to assist a wide range of clients in many fields.

COVERAGE

We provide a myriad of services which includes coverage for the following: merger & acquisition transactions, private placements, performance escrow indemnification, initial offerings/subscription deposits, project finance escrows, paying agent services, cash escrow, tri-party escrow, document escrow, computer source code escrow, payment bond alternative, international surety bonds, commercial purchase & sale closings, lien and judgment holdbacks, leasehold deposits, construction or build out deposits, construction holdbacks, limited liability partnership offerings, installment payments for purchase contracts, oil well production fund escrow, and vendor verification of cash funds prior to shipping product or service delivery. We also deal with sale of goods or services where the parties have no prior relationship with one another. These escrows can be used to insure payments upon written instructions, when time is of the essence, as in real estate transactions or where disbursements are required after an initial agreement.

COVERAGE

We provide a myriad of services which includes coverage for the following: merger & acquisition transactions, private placements, performance escrow indemnification, initial offerings/subscription deposits, project finance escrows, paying agent services, cash escrow, tri-party escrow, document escrow, computer source code escrow, payment bond alternative, international surety bonds, commercial purchase & sale closings, lien and judgment holdbacks, leasehold deposits, construction or build out deposits, construction holdbacks, limited liability partnership offerings, installment payments for purchase contracts, oil well production fund escrow, and vendor verification of cash funds prior to shipping product or service delivery. We also deal with sale of goods or services where the parties have no prior relationship with one another. These escrows can be used to insure payments upon written instructions, when time is of the essence, as in real estate transactions or where disbursements are required after an initial agreement.

A TRUSTED SOURCE

Our company has developed relationships with various financial firms, investors, venture capitalists, bankers and government entities throughout the world. We have access to hundreds of bond companies and and as a result we presently handle a myriad of bond transactions and on occasion credit enhancement. Over our many years we have provided bonds to qualified companies seeking funds for expansion, refinancing, mergers and acquisitions, real property, and oil and gas sectors. We open doors that are otherwise not available and are a collateral alternative to those where traditional financing packages would not be readily available.

BOND GUARANTEES

The surety underwriting process is utilized when a transaction is deemed to have a degree of risk. Risk is the possibility of financial loss due to the potential negligent or damaging actions on the part of the principal. These bonds often time serves as an alternative to Bank Guarantess and Letters of Credit.

Surety bonds are often used to facilitate transactions in which the principal agrees to assume the obligee’s liability. The surety bond carrier pays out if the conditions of the contract are not met and covers the amount of the principal’s financial obligation to the obligee.

Commercial surety bonds are required by entities, government or legislation for projects by individuals or businesses. We place commercial surety bonds for domestic and international projects as well as working with clients’ existing programs and facilitating the release of collateral. The clients we serve for commercial surety bonds range from all sectors including healthcare, financial services, public utilities, and private and public companies. We work with clients to implement bonds tailor made for specific needs.

BOND GUARANTEES

The surety underwriting process is utilized when a transaction is deemed to have a degree of risk. Risk is the possibility of financial loss due to the potential negligent or damaging actions on the part of the principal. These bonds often time serves as an alternative to Bank Guarantess and Letters of Credit.

Surety bonds are often used to facilitate transactions in which the principal agrees to assume the obligee’s liability. The surety bond carrier pays out if the conditions of the contract are not met and covers the amount of the principal’s financial obligation to the obligee.

Commercial surety bonds are required by entities, government or legislation for projects by individuals or businesses. We place commercial surety bonds for domestic and international projects as well as working with clients’ existing programs and facilitating the release of collateral. The clients we serve for commercial surety bonds range from all sectors including healthcare, financial services, public utilities, and private and public companies. We work with clients to implement bonds tailor made for specific needs.

Bonds We Provide

CONTRACT BONDS

PERFORMANCE BONDS

COMPLETION BONDS

SURETY BONDS

Need to talk to us?

Contact us today to find out more about our products and services. One of our representatives will answer all your questions and guide you through the bond process. We have been providing bonds for over 21 years and have a vast knowledge and experience in the industry.